Normality is being restored and many changes are being witnessed with the relaxations being provided by the Government. However, there are somethings are considered to be better if unchanged.

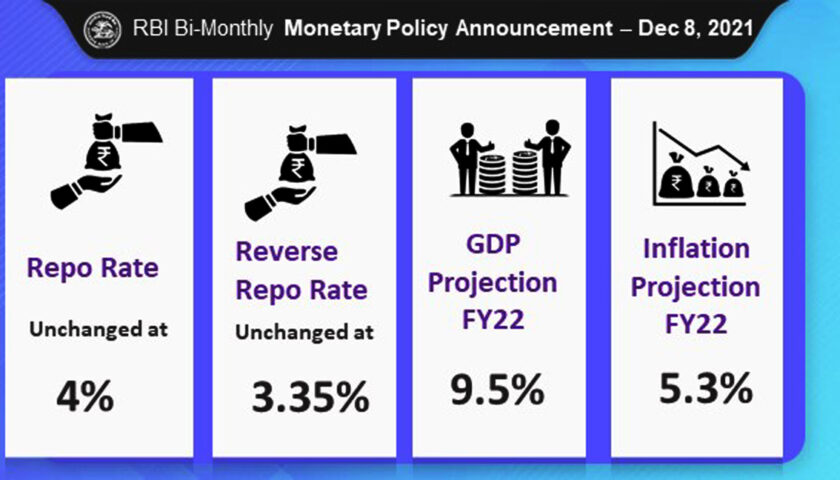

The RBI, Reserve Bank of India,has made the firm decision to keep the Lending Rates Unchanged at 4% to provide a sense of relief to home buyers on Home Loans Sanctioned till March 31, 2021. This has been decided upon to extend a sense of relaxation to Homebuyers as well as help the Real Estate Sector redeem itself from the aftermath of the Lockdown and Slowdown of Economy due to the Coronavirus Pandemic.

The unanimous decision of the Monetary policy Committee(MCP), announcing the unchanged Repo Rate which is 4% and Reverse Repo Rate which is 3.5%, has received both positive as well as neutral responses. Many Real Estate Developers are speculated to believe that with the advent of the Festive Season, the decision might not be in their best interest. However, considering the bigger picture, it is considered as a smart move until the Economy gains its pace back.

The initiative has been made to help the Real Estate Market recover and to trigger the growth. As per the decision, the lower margin requirement on loans worth big sums, will encourage buyers to make investments. This will also be efficacious for metropolitan cities where the prices of properties are higher as the loans will be within their claim and easy to access.

The Real Estate Market is definitely witnessing an upsurge with increased investments and it is predicted to gradually increase, specially with the festive season coming up. The Market has only become more flexible with this decision. It is an apex opportunity for potential Home buyers who wish to buy a home of their own. If a homebuyer was searching for property to invest in Patna, before Coronavirus invaded the normalcy, it is the best time to seal an agreeable deal.

The step taken by RBI is to promote overall growth and encourage smooth transactions to redeem the involved sector and eventually to aid the economy’s all-inclusive growth.The inflation being witnessed has impacted people across all sectors in the market, however, Real Estate impacts the overall economy on a big level, with high market value.

The Decision is definitely good news for new and potential Homebuyers who wish to purchase relatively pricey propertiesin top-notch cities. If you are considering buying apartment in Patna, by Satyamev Group, now is the best time to make a feasible investment.

Satyamev Group offers residential property that exemplifies affordable luxury flats in Patna.