Homebuyers can be categorized as those looking for land and those looking for residential apartments or commercial spaces. While looking for an asset to invest in, these are given a lot of consideration. One of the most important things to consider is the Home or Plot Loan

availability. One often gets intertwined believing these two to be rather similar, however there are a lot of differences between them.

If you are looking to invest in residential property or flats in Patna Top Real Estate Developers like Satyamev Group, a loan is definitely something you must be considering. It is important that you have thorough knowledge of the type of loan you will be eligible for and about it’s requisites. Considering the choice you make, in terms of investment, be it an apartment or residential property, you can avail the relevant loan.

Financial institutions offer loans to buy both residential flats and property, however when sanctioning a loan for property the usage of residential property in Patna is quite evident whereas the reason behind acquiring a plot may create suspicion.

If a plot is bought availing a plot loan, there’s no definitive time period within which construction need to take place, however the area may only be used for construction of residential property. Whereas if you avail a home loan you can use it to buy residential property or utilize the money for construction purposes.

Home loan can be used for only projects that are qualified as residential and not for agricultural or industrial purposes. Plot loans can also be availed specifically for constructing residential projects.

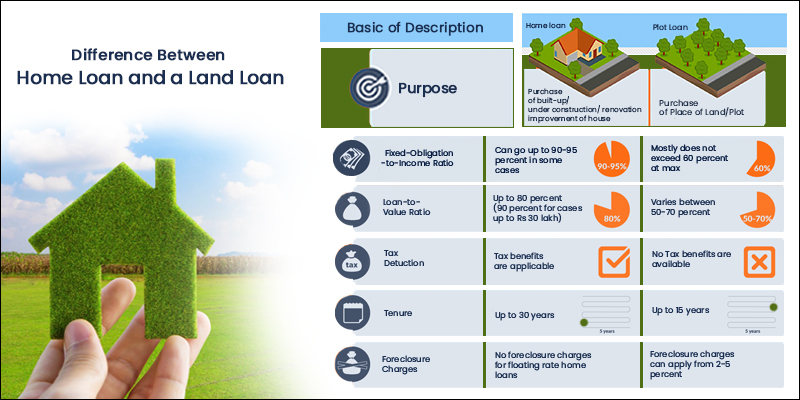

One of the major differences between the two is the LTV (Loan to Value), it refers to the amount of loan you can claim against property. Under affordable Housing, LTV is higher for Home loans considering its association with residential purchases. It is a matter worth taking into account to make sure you make the best suited choice to invest your monetary funds.

Additionally, one must also take into consideration the tax benefits that can be availed while applying for a loan before making up your mind about which property or plot to buy. Applicants of home loan can get tax benefits on the Home loan interest payment or principal amount. On the other hand, there are no such benefits on plot loans.

The tenure of the loan & EMI is consequential. A Home Loan EMI can have a higher tenure in comparison to a Plot loan EMI. Home Loan has a tenure of 30 years while a plot loan’s tenure cannot exceed beyond 15 years. However, the financial institute providing the loan has a major part to play.

To sum up, both types of loans have their own advantageous aspects. However, there are specifics one must consider as well as taking into account ones own best interest & priorities.